Introduction

A review on whether or not One North Eden is suitable for families, real estate investors, both or just a trophy house. This review is done by researching with URA’s Master Plan 2019 for this particular district and location as well as using real estate investing formulas. Find out if this new launch is right for you

| Name: | One North Eden |

|---|---|

| District | 05 |

| Tenure | 99-Year Leasehold |

| Expected TOP | 2023 |

| Address (Multiple) | One North Gateway |

| Number of Units | 165 |

| Bedroom(s) Type | 1 – 4 Bedrooms Available |

| Best for | Family or Investment |

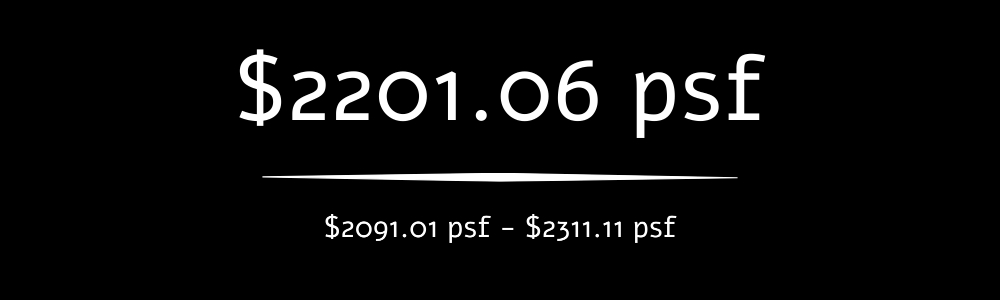

| Worst Case Scenario Pricing (PSF) See Calculation Below | $2,201.06 PSF |

| Average Case Scenario Pricing | Contact Me |

| URA Masterplan 2019 for District 5 and One North Eden | Greater Southern Waterfront West Region |

Mini Conclusion

Always remember the market value of property is highly dependant on the rent you can ask for. If you are in a property where people are willing to pay a higher rent for as compared to another similar property in the vicinity, even if you are not renting out, your property value will naturally be higher.

Also, We will be using One North Residences, another leasehold condominium which TOPed in 2009. This development will be used as a comparison for the calculations.

Are there any points to take note of that might affect the valuation of One North Eden? Here are a few

- Number of units are different. 165 Units for One North Eden and 405 Units for One North Residences

The next section will be on the calculations using Real Estate investing formulas. If you are interested to know more about One North Eden and more specifically on your preferred unit type, feel free to contact me here. A free report will be sent to you once we meet up to discuss your needs, wants and requirements.

If you are interested to see how the calculations are done for investing, you can read further below

Calculations

This is a quick overview on One North Eden and how you would apply real estate investing research, principles and calculations before buying a unit in One North Eden for real estate investment purposes.

The unit we will be analysing will be for a 2 + Study bedroom Unit, Mid floor (11th floor) and also be comparing it with One North Residences which is 130m away.

This is not a review to tell you how awesome this development is, I will be doing this on a separate page of my website, under the listing section, and also on my phone.

Developer(s) Involved

TID Residential, a joint venture between Hong Leong Holdings and Mitsui Fudosan bought over the One North Gateway site for SGD 155.7 million which works out to be around SGD 1,001 PSF.

Hong Leong Holdings was incorporated in 1968 and is one of the pioneers of real estate development in Singapore. In addition to One North Eden, it has also developed the following new launch projects. The Avenir, Penrose, Midwood, Jovell, Sage and the Tate Residences

In addition to properties in Singapore, It also has projects done in China.

Mitsui Fudosan has an even longer history. Dating way back in 1673. Calling itself its current name in the 1950s, it was the company that developed Tokyo’s first skyscraper building in 1968 called the Kasumigaseki Building. Apart from developments in Singapore, they have developments in Japan, Malaysia, Thailand, Indonesia, Philippines, Taiwan, India and USA.

We are working with 2 of the most experienced real estate developers in Singapore for One North Eden

| Developers Involved | Hong Leong Holdings | Mitsui Fudosan |

|---|---|---|

| No of Residential Developments in Singapore (Uncompleted) | 7 | 1 |

| No of Previous Residential Developments in Singapore (Completed) | 30 | 4 |

| No of Overseas Developments | 2 | 60 |

Comparison between One North Eden and One North Residences

| Development | One North Residences | One North Eden |

|---|---|---|

| Tenure | 99 Leasehold | 99 Leasehold |

| Number of Units | 405 | 165 |

| TOP | 2009 | 2023 |

Calculation of Growth Rate (For One North Residences and General)

My research shows the transaction record for the following 2 + Study bedroom unit at 7 One North Gateway (#11-XX), 1,109 sq ft at One North Residences was as follows

Transacting at 9 April 2007 – 905 psf

Transacting at 6 November 2020 – 1425 psf

Time Period: 162 Months (To be rounded down for calculation purposes)

The annual growth rate for One North Residences would be estimated to be around 3.37%. Naturally, the more units you use, the more data you have and the more accurate you will get and. And as mentioned, I usually use 3 other units surrounding the unit I’m planning to buy to have a better estimate of the growth rate in that area.

The annual growth rate for West Region based on SRX Property Index from November 2010 to November 2020 is 3.74%

Let’s just take this at face value. There are many ways we can discuss if we meet why the growth rate should be higher or lower.

Real Estate Investing Formulas used

Before we begin, note that these formulas are usually used for properties which are already existing, similar in age and size. One North Eden will only be completed in 2023 and will be 14 years newer than One North Residences by then. See more in the conclusion section.

Gross Rent Multiplier

The Gross Rent Multiplier Formula for One North Residences for a 2 bedrooms + study unit is as follows

GRM = Sales Price / (Annual Rent of Unit)

= 1,580,000 /(4,100 x 12)

= 32.1138 (Rounded to 4 decimal space)

With the following assumptions taken

Sales Price of 1,580,000 SGD taken for the unit #11-XX 2 bedrooms + study unit which was sold on 6 November 2020

Assumption of the monthly rent of 4,100 SGD based on the worst-case scenario (No stats was given for the floor level, lowest was 4,100 SGD/ Month on 1st June 2020 and highest was 5,800 SGD/Month on 1 September 2020).

Income Capitalisation Method (Modified)

Using the Income Capitalisation Method Formula, the Cap Rate for One North Residences is calculated as follows

Cap rate = Annual Net Operating Income / Market Value

= (Rent Income – Property Tax – Property Insurance – Annual Maintenance Fees – expected Maintenance and Repair – Vacancies Loss) / Market Value

= (49,200 – 5388 – 120 – (450 * 12) – (2 * 4,100)) / 1,580,000

=0.019

Assuming the following

Expected Maintenance and Repair is 0

Maintenance Fee for One North Residences is assumed to be 450 SGD

Calculation for One North Eden using Cap Rate and Gross Rent Multiplier

Using Gross Rent Multiplier for One North Eden

For the assumption of rent for One North Eden,

One North Eden 2 bedrooms + study unit is 764 sqft for their 2 bedrooms + study units.

Using 764/1,109 x 4100 = 2824.53 SGD (Worst Case Scenario)

Using the GRM of 32.1138 to find the sales price for One North Eden

Sales Price = 32.1138 * (2824.53 * 12)

= 1,088,476 SGD (Rounded to whole number)

Using Income Capitalisation Method for One North Eden

Market Value for One North Eden = Net Operating Income / Cap Rate

= (Rent Income – Property Tax – Property Insurance – Annual Maintenance Fees – expected Maintenance and Repair – Vacancies Loss)

= (33,894.32 – 3467.32 – 120 – (450*12) – 5649.05) / 0.019

= 1,011,151 SGD (Rounded to whole number)

Where the following assumptions are made

Maintenance Fee is 450 SGD (Assumed)

Expected Maintenance and Repair to be 0

Using the Time Value of Money Formula

Using the Time Value of Money Formula and using the worst-case scenario growth rate percentage of 3.37% and the 14-year difference between One North Eden and One North Residences, the price per square feet we should be looking to pay for a 2 bedrooms + study 764 sqft mid-floor unit would be $2,201.06 PSF

Conclusion

Do note that the formulas we are using are originally used for existing properties which are similar in age and with rental prices already available. We know that this is not the case as One North Eden will only be ready in 2023.

In addition, we need to also consider the following points

One North Eden will be 14 years newer (2023 – 2009) than One North Residences.

The estimated rent we are using is of the worst case scenario at 2824.53 SGD. What do you estimate the rent will be in 2023 for this area with the knowledge of the URA Master Plan 2019?

One North Residences average rent is already transacting at an average of 4,800 SGD for the year 2020.

One North Eden will be using smart home technology 14 years newer than One North Residences

Buying a unit at One North Residences instead would require renovation cost which can cost upwards of 30,000 SGD to 80,000 SGD and equipment/ appliance cost of 10,000 SGD to 15,000 SGD. If you will be taking the lower end of the renovation cost and equipment cost of buying a unit at One North Residences, this is easily an additional 40K SGD worth of renovation cost you will be saving if you buy a unit from One North Eden.

Congratulations! If you’ve read to this point, you are probably really looking at buying a unit at One North Eden.

This is just a brief thought process on how I would go through with clients who are interested in buying a unit in One North Eden.

If you are looking at buying a 2 bedrooms + study unit in One North Eden, I’ve already done for you 33% of the work. You can find out and do the same calculations for 2 other developments or units which are close to One North Eden with similar facilities to get a more accurate Gross Rent Multiplier and Cap Rate for One North Eden.

If you are looking at buying a Studio, 1-bedroom, 2 bedrooms, 2 bedrooms + study (other layouts), 3-Bedrooms unit or 4-bedrooms, why not send me a WhatsApp message or a quick email via the contact form below and let me represent you in buying a unit.

There are several advantages when I represent you in buying a new launch

NO COMMISSION REQUIRED. Probably the biggest advantage. If I sell this development, the developer pays me the commission, not you.

Free Real estate investing report with calculations on your preferred unit will be done for you upon meetup. Not only will you have all the necessary information, I will also pass you all the floor plans, the images, the pricing and launch price discounts (if any).

If you are looking to buy a unit for investment, I will research the best unit type this condo has to offer to provide you with the maximum returns from your investment money.

If you are looking to buy for home living, I will research and let you know the best floor level and direction facing to get to maximise your sales price.

Basically, I will study these units and provide you with the highest chance of increasing the future capital appreciation potential of your unit

My obligation is only to you. You can look for me for advice for anything real estate related, any time and any day. I don’t work for One North Eden. I have no obligation to sell this development for them and therefore, I have no need to pressure you to buy this unit. If you want to buy, buy, otherwise, we move on and will look out for another unit that is more suited for your needs.

I am part of a team that is very strong in financial calculations. If you are really looking to buy, my team will find different ways and different means to make sure you will be able to afford it. Throw us questions and problems you are currently facing and which your previous agents are unable to answer, let us impress you with what we can do to get you your preferred unit

Buying a condominium (especially for a new launch) for anyone is most probably one of the biggest ticket purchase in their lifetime

Think of me as your friendly and knowledgeable real estate investor friend who’s doing you a favour to make sure the purchase of your new condo is really something worthwhile to purchase or at the very least, something that won’t lose you money in the future.

What are you waiting for? Let’s start!

Disclaimer

The information provided on this Datacrunch Real Estate website has been compiled for your convenience. All information (including but not limited to the property area, floor size, price, address and general property description) on the Datacrunch Real Estate website is provided as a convenience to you.

This disclaimer informs readers that the views, thoughts, and opinions expressed in the text belong solely to the author, and not necessarily to the author’s employer, organization, committee or other group or individual.

Datacrunch Real Estate does not accept liability for any investment decision made on the basis of this information. This website does not constitute financial advice and should not be taken as such.