Introduction

As a real estate agent, I have always been hearing from my friends, family and clients talk about why you shouldn’t buy your real estate investment or new home now because the recession is coming (isn’t it every year you hear that the recession is coming so you shouldn’t start a new business, find a new job, buy a new home or have another kid) so I thought I should just write a short article on how to identify when a recession is coming and what to do with regards to buying real estate in Singapore.

Homer Hoyt, Fred Harrison and the Real Estate Recession Cycle

Homer Hoyt (1895 – 1984) is a real estate economist from the US that has accurately predicted the previous real estate recessions in his hometown of Chicago for the past century since the 1800s when he began to collate his data. Homer Hoyt only inaccurately predicted the recession twice in his lifetime, once during World War 2 (1939 – 1945 where he expected the recession to hit in 1943) and in 1979 when the bank doubled their interest rates. In essence, Homer Hoyt’s theory is that the real estate recession seems to happen every 18 years.

Fred Harrison, another leading economist from the UK used his theory to correctly predict the 2008 real estate recession. In his exact words in an article to The Epoch Times

We know that for centuries, the land value cycle has operated on an 18-year basis. The fact is, there is a very clear 18-year pattern, which is always intersected with a mid-term recession.

The difference between a Real Estate Recession and the normal recession cycle

It’s easy to equate a normal economic recession to a real estate recession as the latest one in 2008 coincided, which got a lot of people spooked because of the double whammy effect.

The biggest difference between a real estate recession and the traditional economic recession is that in a real estate recession, there is a lag time between the demand for real estate and the supply of it and we are currently seeing this happen in Singapore

In 2017, real estate developers in Singapore forecasted a demand for the property for the Singapore population and that created a round of frenzy buying with developers trying to outbid each other to secure pieces of land which led to the current situation where there’s a potential oversupply of 24,000 Empty Apartments and 44,000 Apartments more on the way as quoted by Bloomberg

But whether or not this perceived oversupply will place pressure on the prices is still yet to be seen.

Signs when the Real Estate Recession is coming

But enough of theories, let’s get into the practical side. Fortunately, there’s an article by Havard that show us what we should watch out for to recognise if we are entering into a recession

There are 3 main trends one should look out for to see when the next real estate recession is coming. I will use traffic light graphics to show and keep things easy to understand with the different colours (Green – No Danger, Yellow – Watch Out, Red – Danger)

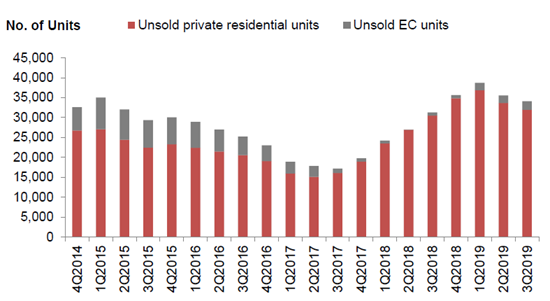

An increase in unsold inventory/ vacancy

Hmmm.. It’s a red light if we are to follow the Bloomberg article?

But if we were to follow the ‘Release of 3rd Quarter 2019 real estate statistics‘ by the Urban Redevelopment Authority of Singapore, the peak happened in the 1Q of 2019 and it is trending downwards at the moment. So we need to look at the trajectory for another 3 or 4 more quarters before we can confirm.

So I would give a yellow light for this.

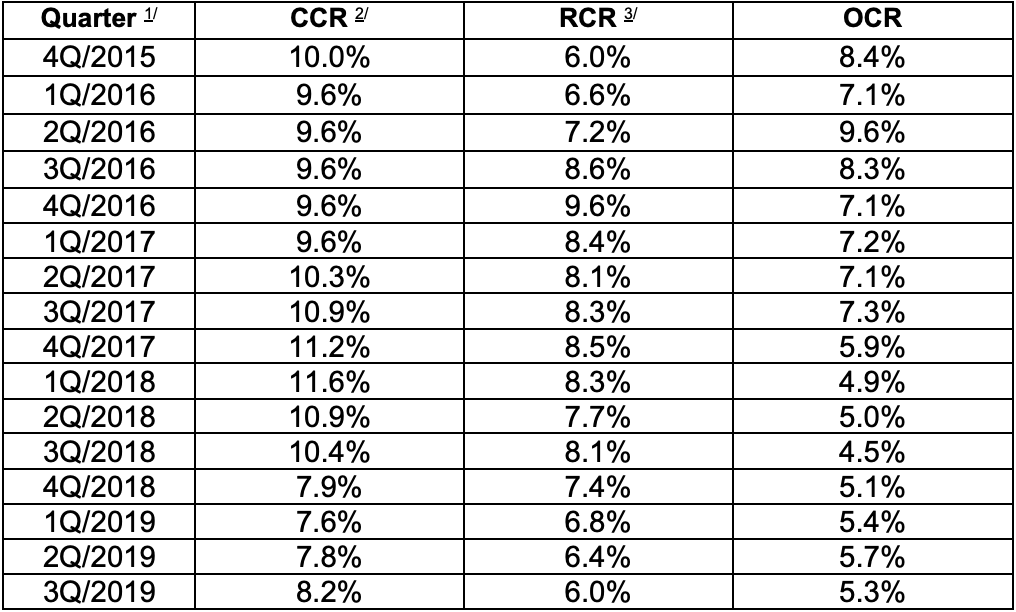

Occupancy falls below the long term average

The vacancy rate data again from URA ranges from 5% – 10% and varies across the Core, Rest and Outside of Central Region. Results from the 1st, 2nd and 3rd Quarter 2019 (4th quarter is till not out yet) shows that it’s hovering at the lower spectrum of the range for the year 2019 so I would say this hasn’t happened yet.

A green light for this.

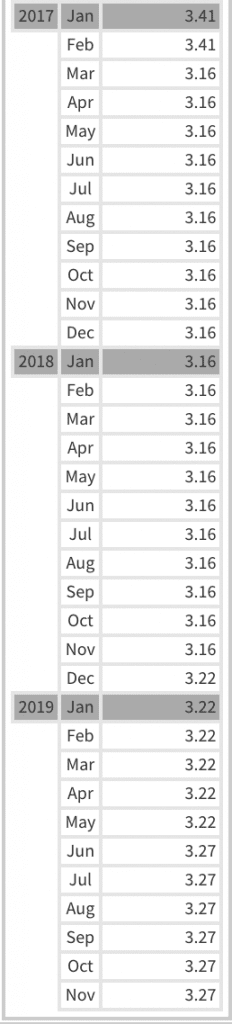

An increase in interest rates

Current statistics of the Banks and Finance Companies for Housing Loan from MAS show that it has been a very gradual increase between 3.16% – 3.27% for the years 2018 to 2019. If we look at a longer timeline, the 3% started way back in 2015, fluctuating from 3.01% to in Feb 2015 to 3.41% in June 2016. So I would say we are still fairly constant.

Another green light for this.

Where are we now (in the Singapore Context)

Judging from the above 3 points, my opinion is that we are still not yet in a recession although constant vigilance on these 3 points for the next few years would be very helpful.

The latest additional cooling measures from 2011 – 2013 set out by the government impacted the estimated 18 years cycle for real estate in Singapore. This means that instead of the expected crash happening in 2026 (The serious one where both the real estate and economic recession would be happening around the same time), Singapore should be expecting the next one to occur between 2029 to 2031.

Of course, we still need to watch out for the signs listed in the previous paragraphs to be more accurate as well as having the assumption that everything is remaining status quo and that the Singapore government is doing nothing to face this upcoming recession. Which we all know is not the case.

The Singapore Government has rolled out several plans to ensure that the next coming recession will not be a drastic one but one which will be softened in several phases for the general population to weather before they enter the next bull market

The next few plans are not all-inclusive but are more relevant to the housing market as the new launches will tend to concentrate around these areas

Jurong Innovation District

Announced in 2016 Singapore Budget, the Jurong Innovation District will be helmed by JTC and will be the where startups will find themselves in Singapore.

Punggol Digital District

Announced in 2015 National Day Rally and again in 2017 Singapore Budget, Punggol Digital District will be developed by JTC as the next Silicon Valley of Singapore. In addition, the new Singapore Institute of Technology campus will be set up here. They are aiming for completion by 2023.

CBD Decentralisation plan for Paya Lebar Central

As part of the Singapore’s Government effort to decentralise the CBD and the relocation of Paya Lebar Airbase, developers will have the opportunity to revamp the vacated land by building new homes, new offices and new factories with higher density. The buildings currently located in Paya Lebar have a height restriction due to the close proximity of Paya Lebar Airbase.

Greater Southern Waterfront

The relocation of the current PSA City Terminal from 2027 onwards as part of the Greater Southern Waterfront development plan will free more space for offices and houses to be built.

Marina Bay

Similar to Paya Lebar, Jurong and Punggol, the Marina Bay Area is one of the areas earmarked by the Singapore Government to move offices away from the CBD area and increasing the residential population in Singapore. Marina Bay is also part of the Greater Southern Waterfront as it is located at the eastern fringe.

Conclusion and What it means for you

So if you were to come to me now and tell me that the recession is coming, I would totally agree with you. A recession will come as it has come and gone for the past 200 years.

But if you say now is not a good time to buy because the recession is coming, I would have to disagree with you because

- Now you already know what you need to watch out for to determine if there’s really a recession coming

- Even if we are in the recession, buying a new home using the proper real estate investing calculations will let you know which properties are overpriced or undervalued.

- The property price index for Singapore since 1975 is always on an upward trend. The lowest point of every dip in the property price is always higher than the previous dip. So if you are buying a unit more for personal reasons, as compared to a real estate investor, your unit that you buy, if chosen, budgeted and calculated properly, will always be a constant hedge against inflation.

Knowing when will be a good time to place your money in real estate and the locations where to invest your money when buying your next home will further increase your chances of getting a new home with the highest chances of good capital appreciation.

And this is something I can help you with and I would love to be part of your journey. If you are interested, contact me by filling up the form below and have a quick discussion on your wants, needs, budget and preferred location and we can work together finding you your next perfect home in Singapore.

Disclaimer

The information provided on this Datacrunch Real Estate website has been compiled for your convenience. All information (including but not limited to the property area, floor size, price, address and general property description) on the Datacrunch Real Estate website is provided as a convenience to you.

This disclaimer informs readers that the views, thoughts, and opinions expressed in the text belong solely to the author, and not necessarily to the author’s employer, organization, committee or other group or individual.

Datacrunch Real Estate does not accept liability for any investment decision made on the basis of this information. This website does not constitute financial advice and should not be taken as such.