Introduction

A case study using real estate investing formulas and research on a previous new launch Urban Vista. I am assuming I am planning to buy a 3 bedroom 797 square feet low-floor unit at Urban Vista in May of 2013. So I will just use the transaction records of the surrounding condos, East Meadows, The Tanamera and Casa Meadows, up to May of 2013.

I don’t take into account the Masterplan, who the developers are or even the location because I just want to show you how the calculations can tell you alone if it was worth buying Urban Vista back in May 2013.

| Name | Urban Vista | East Meadows | The Tanamera | Casa Merah |

|---|---|---|---|---|

| District | 16 | 16 | 16 | 16 |

| Tenure | 99-Year Leasehold | 99-Year Leasehold | 99-Year Leasehold | 99-Year Leasehold |

| TOP | 2002 | 2001 | 1994 | 2009 |

| Address (Multiple) | Tanah Merah Kechil Link, 465417, Bedok / Upper East Coast | Tanah Merah Kechil Road, 465558, Bedok / Upper East Coast | Tanah Merah Kechil Road, 466663, Bedok / Upper East Coast | Tanah Merah Kechil Avenue, 465524, Bedok / Upper East Coast |

| Number of Units | 582 | 482 | 288 | 556 |

| Bedroom(s) Type | 1 – 5 Bedrooms | 2 – 4 Bedrooms | 1 – 3 Bedrooms | 2 – 3 Bedrooms |

Mini Conclusion

Here are the observations

On May 2013, the calculations for Urban Vista are showing the following

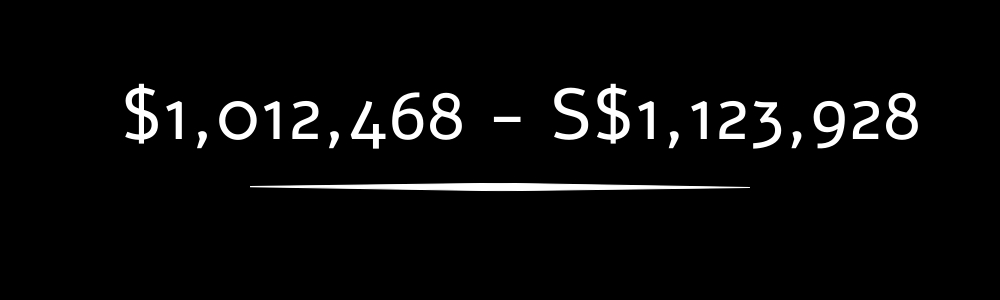

- The calculated market value of the 3 bedroom 4th floor 797sqft Urban Vista Condo in 2016 when it’s due to be completed was between S$1,012,468.23 and $1,123,928.02 depending on whether a 2% or 3% growth rate is used and depending on which condo you are comparing against.

- In May 2013, the 3 Bedroom 4th floor 797sqft unit was selling at a developer price of S$1,216,433.00 which means you will be purchasing this unit at around S$200K above market value based on 2% growth rate (Worst Case Scenario).

- As an real estate investor, who is clearly looking at just the capital gain appreciation potential and possibly cashing out at TOP, this would not a unit I would consider investing my money in as the numbers are showing that I would be overpaying for a unit and I know that once I’m overpaying for a unit, the annual growth rate will drop to between 0 – 1% on average.

- As a potential home-owner, at least I am aware of this number and know that I am purchasing this unit purely because of the location or layout that I like.

- On October 2021, this particular 4th floor unit was sold at S$1,000,000. Netting the purchaser a loss of at least S$216K after 8 years of holding the property. Considerably more if you count the bank interest paid for the home loan for 8 years.

- Furthermore, extrapolating the 2016 market value numbers that we are seeing to the year 2021, the calculations are showing it to be worth between S$1,118,857.30 – S$1,305,573.65 in 2021 which means that this unit was sold undervalued at S$1,000,000. When we look at the next 4 transactions after this unit was sold, we can see that the units, although slightly larger and at a higher floor, were transacted at these range of numbers

| Unit Number | Unit Size | Date Sold | Sale Price |

|---|---|---|---|

| #09-XX | 850 sqft | 17 November 2021 | S$1,150,000 |

| #07-XX | 850 sqft | 16 December 2021 | S$1,150,000 |

| #12-XX | 893 sqft | 29 December 2021 | S$1,288,000 |

| #10-XX | 850 sqft | 18 January 2022 | S$1,120,000 |

Interested to know how these calculations are done and how I’m getting these numbers, do continue reading!

Calculations

As mentioned above, we are assuming that I am interested to buy a 4th floor, 797sqft, 3 bedroom new launch called Urban Vista in 2013 and will use real estate investing formulas to calculate and see if it’s a real estate investment or not.

This calculation is done be comparing it with 3 units of similar size and bedrooms of different condos near Urban Vista.

The three surrounding condos are as follows

| Condo Name | Unit Number | Unit Size |

|---|---|---|

| East Meadows | #04-XX | 1356 sqft |

| The Tanamera | #13-XX | 1303 sqft |

| Casa Merah | #01-XX | 1270 sqft |

Surrounding Condos Transactions

| East Meadows | The Tanamera | Casa Merah | |

|---|---|---|---|

| Unit Bought | 1 September 2009 at S$912,000 | 18 August 2006 at S$480,000 | 17 June 2009 at S$850,900 |

| Unit Sold | 8 March 2013 at S$1,260,000 | 22 April 2013 at $1,180,000 | 12 March 2013 at S$1,458,000 |

| Number of Months | 42 | 80 | 44 |

| Growth Rate | 9.27% | 13.57% | 11.93% |

This growth rate numbers are usually a sign of a property bubble. In Singapore, if you are purely in for investment and already own a unit with the surrounding transactions in your condo showing these numbers, I do highly recommend to sell it to lock in the capital gains and look for another unit elsewhere to grow your investment as it is very hard to sustain such growth. Naturally if you are buying to stay, then this plays a lesser role.

Calculation of Growth Rate (East Region)

The annual growth rate for the east region based on SRX Property Index from March 2006 to March 2013 is 11.93%.

Again we are seeing numbers that are not at a sustainable level for property. And as a result, we should take a conservative estimate of either 2% or 3% for the formulas used later for a realistic approximation of the market value of the Urban Vista unit. For an example of how I derive these numbers, take a look at the link ‘The Annual Growth Rate of Real Estate Investing‘

Real Estate Investing Formulas used

Before we begin, note that these formulas are usually used for properties which are already existing, similar in age and size. Urban Vista was only due to be completed in 2016 and will be considerably newer than the other condos. See more in the conclusion section.

Gross Rent Multiplier

The Gross Rent Multiplier Formula for the three condos for a 3 bedrooms unit are as follows

| East Meadows | The Tanamera | Casa Merah | |

|---|---|---|---|

| Sales Price | S$1,260,000 | S$1,180,000 | S$1,458,000 |

| Annual Rent | S$42,000 | S$42,000 | S$45,600 |

| Gross Rent Multiplier | 30.0000 | 28.0952 | 31.9737 |

The average Gross Rent Multiplier is 30.0230

With the following assumptions taken

- Lowest rent taken into calculation for Annual Rent for conservative purposes

- Calculation of the lowest and highest rent taken for the year 2013 for the 3 condos

- East Meadows (Lowest: S$3,500/Month | Highest: S$4,350/Month)

- The Tanamera (Lowest: S$3,500/Month | Highest: S$4,500/Month)

- Casa Merah (Lowest: S$3,800/Month | Highest: S$4,530/Month)

Income Capitalisation Method (Modified)

Using the Income Capitalisation Method Formula, the Cap Rate for the 3 condos are calculated as follows

| East Meadows | The Tanamera | Casa Merah | |

|---|---|---|---|

| Annual Net Operating Income | S$26,840 | S$26,840 | S$29,396 |

| Market Value | S$1,260,000 | S$1,180,000 | S$1,458,000 |

| Cap Rate | 0.0213 | 0.0227 | 0.0202 |

Cap rate = Annual Net Operating Income / Market Value

= (Rent Income – Property Tax – Property Insurance – Annual Maintenance Fees – expected Maintenance and Repair – Vacancies Loss) / Market Value

The average of Income Capitalisation Rate is 0.0214.

Assuming the following

- Expected Maintenance and Repair is 0

- The maintenance fee for Urban Vista is assumed to be 300 SGD

Calculation for Urban Vista using Cap Rate and Gross Rent Multiplier

Using Gross Rent Multiplier for Urban Vista

For the assumption of rent for Urban Vista, we assume to be S$2,057.15 – $$2384.72 as the 3 bedroom units for Urban Vista are considerably smaller at 797 sqft.

Using the average GRM of 30.0230 and multiplying it with the various lowest rent to find the sales price for Urban Vista based on which condo we are comparing with, we get the following

- Comparing with East Meadows = S$741,142.36

- Comparing with The Tanamerah = S$755,055.16

- Comparing with Casa Merah = S$859,158.23

Using Income Capitalisation Method for Urban Vista

Market Value for Urban Vista = Net Operating Income / Cap Rate

= (Rent Income – Property Tax – Property Insurance – Annual Maintenance Fees – expected Maintenance and Repair – Vacancies Loss)

Using the same methodology as used for the GRM, we calculate the market value of Urban Vista as follows

- Comparing with East Meadows = S$672,031.29

- Comparing with The Tanamerah = S$692,458.13

- Comparing with Casa Merah = S$806,718.04

Where the following assumptions are made

- The maintenance fee is 300 SGD (Assumed)

- Expected Maintenance and Repair to be 0

Using the Time Value of Money Formula

Using the Time Value of Money Formula and using the worst-case scenario with growth rate percentage of 2% and 3% and the years difference between Urban Vista and the surrounding three condos, the price we should be looking to pay for a 3 bedrooms 797 sqft 4th-floor unit would be between S$1,012,468 and S$1,123,928.

Conclusion

Back in May 2013, the asking price for Urban Vista 4th floor 3 bedroom unit was S$1,216,433.

As a real estate investor, I would choose another condo to purchase because as at its worst case, I am buying a unit that’s almost 200K above market value and I know that once a condo (new launch or resale) is purchased above market value, there would be only minimal expectation of growth rate appreciation for my unit.

As someone looking for a new home, I would know this number and then decide if buying S$200K above market value is worth for the convenience, amenities and location.

As a real estate investing consultant, it is not for me to persuade you to buy or not to buy your next home for investment or homestay. My duty to my buyers is to show you the growth rate and expected appreciation for any property in the market now.

Congratulations! If you’ve read to this point, you are probably really looking at buying a residential property within the next few years and I would consider it an honour to be your property agent.

There are several advantages when I represent you in buying a residential property (New Launch or Resale)

- No commission required to be paid by you for Private Properties (Resale or New Launch). Probably the biggest advantage. If I represent you, either the developer or the owner pays me the commission, not you.

- A free real estate investing report with calculations on your preferred unit will be done for you upon meetup. For new launches, I will also pass you all the floor plans, e-brochures, pricing and launch price discounts (if any).

- If you are looking to buy a unit for investment, I will research the best unit type this condo has to offer to provide you with the maximum returns from your investment money.

- If you are looking to buy for your own stay, I will research and let you know the best floor level and direction facing and layout type within your budget to maximise your future sales price. If the calculations are not favourable, at least you will know how much extra you will be paying for. The decision whether it’s worth it to purchase lies with you.

My obligation is only to you. You can look for me for advice for anything real estate related, any time and any day. I don’t work for anyone else and have no obligation to sell this development for them and therefore, I have no need to pressure you to buy anything. If you want to buy, buy, otherwise, we move on and will look out for another unit that is more suited for your needs.

I am part of a team that is very strong in financial calculations. If you are really looking to buy, my team will find different ways and different means to make sure you will be able to afford it. Throw us questions and problems you are currently facing and which your previous agents are unable to answer, let us impress you with what we can do to get you your next home.

Buying a condominium (especially for a new launch) for anyone is most probably one of the biggest ticket purchase in their lifetime

Think of me as your friendly and knowledgeable real estate investor friend who only has your interest at heart and is firmly committed to providing you an honest advice on your home as a real estate asset.

What are you waiting for? Let me know how I can help you

Disclaimer

The information provided on this Datacrunch Real Estate website has been compiled for your convenience. All information (including but not limited to the property area, floor size, price, address and general property description) on the Datacrunch Real Estate website is provided as a convenience to you.

This disclaimer informs readers that the views, thoughts, and opinions expressed in the text belong solely to the author, and not necessarily to the author’s employer, organization, committee or other group or individual.

Datacrunch Real Estate does not accept liability for any investment decision made on the basis of this information. This website does not constitute financial advice and should not be taken as such.