Introduction

A case study using real estate investing formulas and research on a previous new launch. I am assuming I am planning to buy a 3 bedroom 947 square feet mid-floor unit at Queens Peak in November of 2016. So I will just use the transaction records up to November of 2016 and comparing it with Queens Condo which is just 200m away. I don’t take into account the Masterplan, who the developers are or even the location because I just want to show you how the calculations can tell you alone if it was worth buying Queens Peak back in November 2016.

| Name | Queens | Queens Peak |

|---|---|---|

| District | 3 | 3 |

| Tenure | 99-Year Leasehold | 99-Year Leasehold |

| TOP | 2002 | 2020 |

| Address (Multiple) | Stirling Road, 148954, Alexandra / Commonwealth | Dundee Road, 149999, Alexandra / Commonwealth |

| Number of Units | 722 | 700 |

| Bedroom(s) Type | 2 – 4 Bedrooms | 1 – 5 Bedrooms and Penthouses |

Mini Conclusion

Here are the observations

On November 2016, the calculations are showing the following

- The calculated market value of the 3 bedroom 16th floor 947sqft Queens Peak Condo in 2020 was 1,938,603.03. Giving a 5% margin of error on both sides, we are looking at a range between 1,841,672.88 and 2,035,533.18. We are not yet seeing this number transacted yet. However, people are listing such units in Propertyguru around this pricing right now. I’m fairly confident it will reach these numbers within the next 5 years because of the knowledge of where we are on the Real Estate Cycle.

If you are interested to see how the calculations are done, you can read the calculations further below

Calculations

As mentioned above, we are assuming that I am interested to buy a 16th floor, 947sqft, 3 bedroom new launch called Queens Peak Condo in November 2016 and will use real estate investing formulas to calculate and see if it’s a real estate investment or not.

This calculation is done be comparing it with 3 units of similar size at Queens which is 200m away from Queens Peak.

Queens Transactions

| Queens | #11-XX | #13-XX | #12-XX |

|---|---|---|---|

| Unit Bought | 27 January 2011 at S$1,360,000 | 24 August 2000 at S$877,000 | 16 August 2000 at S$822,000 |

| Unit Sold | 19 October 2016 at S$1,450,000 | 14 September 2016 at $1,427,000 | 18 July 2016 at S$1,430,000 |

| Number of Months | 68 | 192 | 191 |

| Growth Rate | 1.13% | 3.05% | 3.48% |

I included the first transaction to explain why this unit is not enjoying the same growth rate percentage as the other two. There are two main reasons.

- He bought in 2011. If you realised in Edgeprop’s weekly article of top gainers and top losers in the residential property market in Singapore, you will realise that the majority of people who made the most from their property bought between 2000 – 2004 while the majority of people who lost seems to buy their property between 2010 and 2014.

- He bought it overpriced. This unit was first sold on 19 February 2002 at S$690,000. Using the Time Value of Money formula with a conservative 3% growth rate in 107 months, the property should be worth around S$901,320 in 2011. In simple terms, he overpaid for his property around S$400K in 2011.

To achieve a property growth from S$690,000 to S$1,360,000 in 107 months (close to 9 years), the annual growth rate would need to be 7.63%. I would be more cautious if I’m the buyer because this growth rate is hard to sustain in the Singapore residential property market. But if you are the investor selling this property and you are seeing these numbers, I would suggest selling to lock in the capital gains and start looking for another property to put your money in because there will not be much growth after that which you can see in the 3rd transaction above. In 68 months, the property gain only S$90K. Of course, if you are using this home as a residential home, this plays a lesser role.

I have to stress that the timing alone does not determine whether or not the property is an investment. I’ve done calculations on properties that were bought between 2000 and 2004 and lost money and found properties in Singapore that were sold between 2010 and 2014 and made money. The calculations have always been the more accurate indicator.

On a side note, if the real estate cycle lasts an average of 18 years, you can calculate when the next property cycle boom or bust is coming. PM me if you want to know.

Calculation of Growth Rate (Central Region)

The annual growth rate for the central region based on SRX Property Index from November 2006 to November 2016 is 6.43%

Let’s just take this at face value. There are many ways we can discuss if we meet why the growth rate should be higher or lower.

Real Estate Investing Formulas used

Before we begin, note that these formulas are usually used for properties which are already existing, similar in age and size. Queens Peak was only due to be completed in 2020 and will be 18 years newer than Queens by then. See more in the conclusion section.

Gross Rent Multiplier

The Gross Rent Multiplier Formula for Queens for a 3 bedrooms unit at 1195 sqft are as follows

| Queens | #11-XX | #13-XX | #12-XX |

|---|---|---|---|

| Sales Price | S$1,450,000 | S$1,427,000 | S$1,430,000 |

| Annual Rent | S$42,000 | S$42,000 | S$42,000 |

| Gross Rent Multiplier | 34.5234 | 33.9762 | 34.0476 |

With the following assumptions taken

- Assumption of the monthly rent of 3,500 SGD based on the worst-case scenario to lower the risk (No stats are given for the floor level, lowest was 3,500 SGD/ Month on 1st October 2016 and highest was 5,600 SGD/Month on 1st September 2016.

Income Capitalisation Method (Modified)

Using the Income Capitalisation Method Formula, the Cap Rate for Queens is calculated as follows

| Queens | #11-XX | #13-XX | #12-XX |

|---|---|---|---|

| Annual Net Operating Income | S$26,840 | S$26,840 | S$26,840 |

| Market Value | S$1,450,000 | S$1,427,000 | S$1,430,000 |

| Cap Rate | 0.0185 | 0.0188 | 0.0188 |

Cap rate = Annual Net Operating Income / Market Value

= (Rent Income – Property Tax – Property Insurance – Annual Maintenance Fees – expected Maintenance and Repair – Vacancies Loss) / Market Value

Assuming the following

- Expected Maintenance and Repair is 0

- The maintenance fee for Queens is assumed to be 300 SGD

Calculation for Queens Peak using Cap Rate and Gross Rent Multiplier

Using Gross Rent Multiplier for Queens Peak

For the assumption of rent for Queens Peak, we assume to be S$2,773.64 as the 3 bedroom units for Queens Peak are at 947 sqft.

Using the average GRM of 38.1825 to find the sales price for Queens Peak

Sales Price = 38.1825 * (2,773.64 * 12)

= S$1,137,720.78 SGD (Rounded to whole number)

Using Income Capitalisation Method for Queens Peak

Market Value for Queens Peak = Net Operating Income / Cap Rate

= (Rent Income – Property Tax – Property Insurance – Annual Maintenance Fees – expected Maintenance and Repair – Vacancies Loss)

= S$20,622.36 / 0.0187

= S$1,103,030.73 SGD (Rounded to whole number)

Where the following assumptions are made

- The maintenance fee is 300 SGD (Assumed)

- Expected Maintenance and Repair to be 0

Using the Time Value of Money Formula

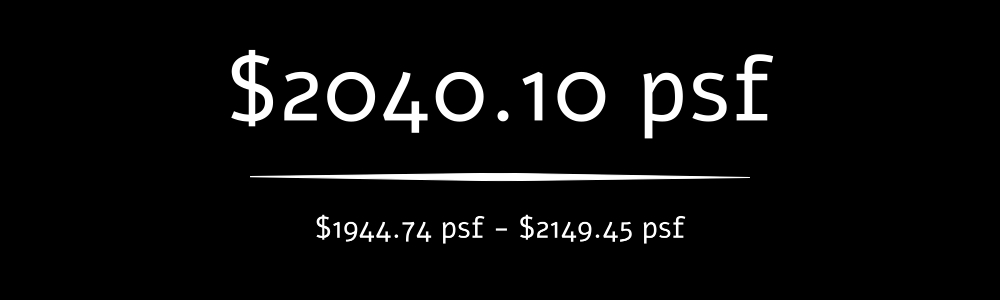

Using the Time Value of Money Formula and using the worst-case scenario growth rate percentage of 3.05% and the 18-year difference between Queens and Queens Peak, the price per square feet we should be looking to pay for a 3 bedrooms 947 sqft 16th-floor unit would be $2,040.10 psf.

Conclusion

Back in 2016, the asking price for Queens Peak 16 floor 3 bedroom unit was S$1,438,200. If you knew back then that you are paying S$1,438,200 for a unit that will be valued at S$1,938,603.03 in 4 years time, would you buy if you had the means?

Congratulations! If you’ve read to this point, you are probably really looking at buying a residential property within the next few years and I would consider it an honour to be your property agent.

There are several advantages when I represent you in buying a residential property (Resale or New Launch)

- No commission required to be paid by you for Private Properties (Resale or New Launch). Probably the biggest advantage. If I represent you, either the developer or the owner pays me the commission, not you.

- A free real estate investing report with calculations on your preferred unit will be done for you upon meetup. For new launches, I will also pass you all the floor plans, e-brochures, pricing and launch price discounts (if any).

- If you are looking to buy a unit for investment, I will research the best unit type this condo has to offer to provide you with the maximum returns from your investment money.

- If you are looking to buy for your own stay, I will research and let you know the best floor level and direction facing and layout type within your budget to maximise your future sales price. If the calculations are not favourable, at least you will know how much extra you will be paying for. Then you will know whether or not it is worth it to purchase.

My obligation is only to you. You can look for me for advice for anything real estate related, any time and any day. I don’t work for anyone else and have no obligation to sell this development for them and therefore, I have no need to pressure you to buy anything. If you want to buy, buy, otherwise, we move on and will look out for another unit that is more suited for your needs.

I am part of a team that is very strong in financial calculations. If you are really looking to buy, my team will find different ways and different means to make sure you will be able to afford it. Throw us questions and problems you are currently facing and which your previous agents are unable to answer, let us impress you with what we can do to get you your next home.

Buying a condominium (especially for a new launch) for anyone is most probably one of the biggest ticket purchase in their lifetime

Think of me as your friendly and knowledgeable real estate investor friend who’s doing you a favour to make sure the purchase of your new condo is really something worthwhile to purchase or at the very least, something that won’t lose you money in the future.

What are you waiting for? Let me know how I can help you

Disclaimer

The information provided on this Datacrunch Real Estate website has been compiled for your convenience. All information (including but not limited to the property area, floor size, price, address and general property description) on the Datacrunch Real Estate website is provided as a convenience to you.

This disclaimer informs readers that the views, thoughts, and opinions expressed in the text belong solely to the author, and not necessarily to the author’s employer, organization, committee or other group or individual.

Datacrunch Real Estate does not accept liability for any investment decision made on the basis of this information. This website does not constitute financial advice and should not be taken as such.