Introduction

This is a preview on what to expect for NoMa when it eventually opens to the public. My calculations are usually done when I have more information on the floor size and the asking price of the various available units for the said development.

See the review of Parc Clematis for an example of how the calculations are done.

As we do not have these information yet, we have to make do with what other information we are currently given and based on that, we will know how much the asking price should be and then decide accordingly.

If you just want to know the answer now. It’s 1733.83 psf.

So with a standard 5 percent margin of error at 95% confidence level, simply because no one can predict the future, an appropriate price range of the psf would be between $1647.13 psf to $1820.52 psf

Depending on your risk tolerance and at this price range, you will be buying a development that should be at a good value investment-wise because we are working on the worst case scenario.

If you are interested to know how I come out with this number and the range, please read on.

What we know

Here’s a list of what we already know about NoMa (August 2020).

Tenure

NoMa will be Freehold. Same with Guillemard Edge. Calculations-wise, we will be comparing a Freehold development with another Freehold development.

Location

NoMa will be built right next to the Guillemard Edge at Lorong 30 Geylang. And similar to the above point, this would be the best comparison to do, the Gross Rent Multiplier number should be roughly the same.

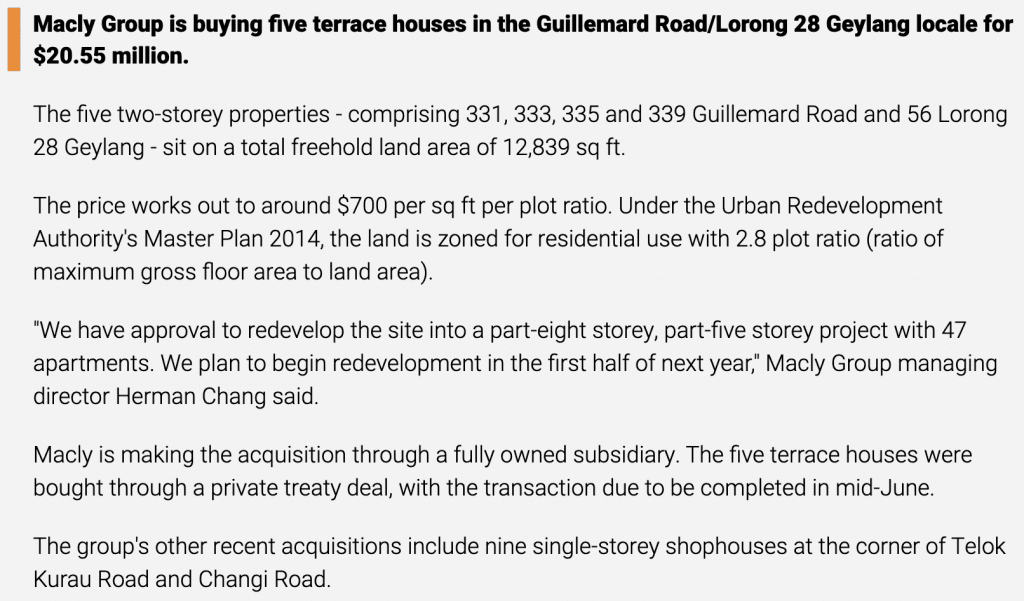

Developer

Developer for NoMa is Macly Group.

Land Price PSF

Macly Group bought the land at 700 psf.

Assumptions Made

Here are the assumptions I’ve made regarding NoMa. This will be corrected once we have the full information from the developer and reflected on the upcoming review of NoMa.

Floor plan

I will be comparing the known floor plan size of 1 bedroom at 463 sqft. If the numbers change when the information are out, I will adjust accordingly in the upcoming review for NoMa.

Type of Buildings and Units Available

It is expected to consist of 3 buildings with only 50 available units.

Comparison with The Guillemard Edge

Due to the close proximity of Guillemard Edge and the multiple similar features between the 2 developments, the Gross Rent Multiplier and Income Capitalisation Method should be as close as it can get.

Transacted Record of the Guillemard Edge

Guillemard Edge received their TOP status in 2015. Based on the latest 1 bedroom transaction, here are the following details

| Date | Type | Size | $ |

|---|---|---|---|

| 13 March 2012 | 1-Bedroom #05-XX | 441 sq ft | 544,000 |

| 20 July 2020 | 1-Bedroom (Same Unit) | 441 sq ft | 648,000 |

In 8 years, it has achieved a gross capital gain of $104,000 with an annual growth rate of 2.10%.

The annual growth rate of the east region is at 2.98%.

We will use the annual growth rate of 2.10% as we are working on the worst case scenario.

The transacted rental records (lowest and highest) for similar units are as follows

| Month | $ |

|---|---|

| 1st March 2020 | 1,650 |

| 1st July 2020 | 2,200 |

We shall use the lowest rent receivable at 1,650 SGD per month for the worst case scenario

GRM of the surrounding area

The Gross Rent Multiplier (GRM) for Guillemard Edge is calculated as

GRM = Sales Price / (Annual Rent of Unit)

= 648,000 /(1,650 x 12)

= 32.7273 (Rounded to 4 decimal space)

With the following assumptions taken

Sales Price of 648,000 SGD taken for the unit #05-XX 1 bedroom which was sold on 20 July 2020

Assumption of Annual Rent of 2,200 SGD taken for the lowest rent transacted on 1st July 2020

Income Capitalisation Rate

The Income Capitalisation Rate formula is as follows

Cap rate = Annual Net Operating Income / Market Value

= (Rent Income – Property Tax – Property Insurance – Annual Maintenance Fees – expected Maintenance and Repair – Vacancies Loss) / Market Value

= (19,800 – 1980 – 120 – (320 * 12) – (2 * 1650)) / 648,000

= 0.0167

Assuming the following

- Expected Maintenance and Repair is 0

- Maintenance Fee for the Guillemard Edge is assumed to be 320 SGD

Calculation for NoMa using Gross Rent Multiplier and Income Capitalisation Rate

As we are assuming the same numbers for NoMa, we can calculate the future value of NoMa by using the worst case scenario growth rate of 2.10% with the knowledge that it is expected to TOP in 2023.

The future Value of NoMa in 2023 with a 2.10% growth rate is

$802,761.31

Dividing by the 463 sqft size of the unit, we get the price psf of

$1733.83

With a 5 percent margin of error at a 95% confidence level, we get a price range of

$1647.13 psf to $1820.52 psf

My thoughts on the Market Value of NoMa

Let me stress that one transaction record does not determine the GRM and ICR of the development. I try to work on 9 other transactional records from 3 different developments for a more accurate number if available.

And also that we do not have the confirmed floor size, price and floor level of the upcoming NoMa. All of this, which will play a factor in the real estate investing calculations.

The upcoming review of NoMa, when we have more information from the developer, will further determine if it’s a good investment for your next home.

Conclusion

Congratulations! If you’ve read to this point, you are probably really looking at checking out the show flat for NoMa and knowing more about this upcoming development at Sims Drive.

This is just a brief thought process on how I would go through with clients who are interested in buying a unit in NoMa

There are several advantages when I represent you in buying a new launch

- NO COMMISSION REQUIRED. Probably the biggest advantage. If I sell this development, the developer pays me the commission, not you.

- Free Real estate investing report with calculations on your preferred unit will be done for you upon meet-up. Not only will you have all the necessary information, I will also pass you all the floor plans, the images, the pricing and launch price discounts (if any).

- If you are looking to buy a unit for investment, I will research the best unit type this condo has to offer to provide you with the maximum returns from your investment money. If you are looking to buy for home living, I will research and let you know the best floor level and direction facing to get to maximise your sales price. Basically, I will study these units and provide you with the highest chance of increasing the future capital appreciation potential of your unit

- My obligation is only to you. You can look for me for advice for anything real estate related, any time and any day. I don’t work for NoMa. I have no obligation to sell this development for them and therefore, I have no need to pressure you to buy this unit. If you want to buy, buy, otherwise, we move on and will look out for another unit that is more suited for your needs.

- I am part of a team that is very strong in financial calculations. If you are really looking to buy, my team will find different ways and different means to make sure you will be able to afford it. Throw us questions and problems you are currently facing and which your previous agents are unable to answer, let us impress you with what we can do to get you your preferred unit

Buying a condominium (especially a new launch) for anyone is most probably one of the biggest ticket purchase in their lifetime

Think of me as your friendly and knowledgeable real estate investor friend who’s doing you a favour to make sure the purchase of your new condo is really something worthwhile to purchase or at the very least, something that won’t lose you money in the future.

What are you waiting for? Let’s start!

Disclaimer

The information provided on this Datacrunch Real Estate website has been compiled for your convenience. All information (including but not limited to the property area, floor size, price, address and general property description) on the Datacrunch Real Estate website is provided as a convenience to you.

This disclaimer informs readers that the views, thoughts, and opinions expressed in the text belong solely to the author, and not necessarily to the author’s employer, organization, committee or other group or individual.

Datacrunch Real Estate does not accept liability for any investment decision made on the basis of this information. This website does not constitute financial advice and should not be taken as such.