As I’ve said to many of my clients. HDBs do not seem to follow the standard real estate investing formulas that’s commonly used for commercial and residential properties. So while it is still possible to calculate the market value of HDB flats so that you know if you are overpaying for your HDB flat, I cannot tell you, if your HDB flat will hold its value, decrease or increase in the next few decades because it’s all really dependant on how much buyers are willing to pay for a HDB flat, and not on how much rent you can ask for in the next few years due to the redevelopment of the area (if any).

To illustrate my example, I will compare 2 developments which I’ve chosen because it’s quite recent. A HDB which MOPed in 2017, Blk 416A Clementi Avenue 1 and Clement Canopy which was launched in 2017 and show you the net difference between your networth if you chose to stick with your HDB or if you upgraded to a private property.

As Parc Clematis already launched and Clavon will be launching soon (Message me for more details), this is particularly for those people who have HDB flats MOPing this year.

I will try as much as possible to stick to readily available data from PropertyGuru so you can always refer to the data and calculations yourself.

Background

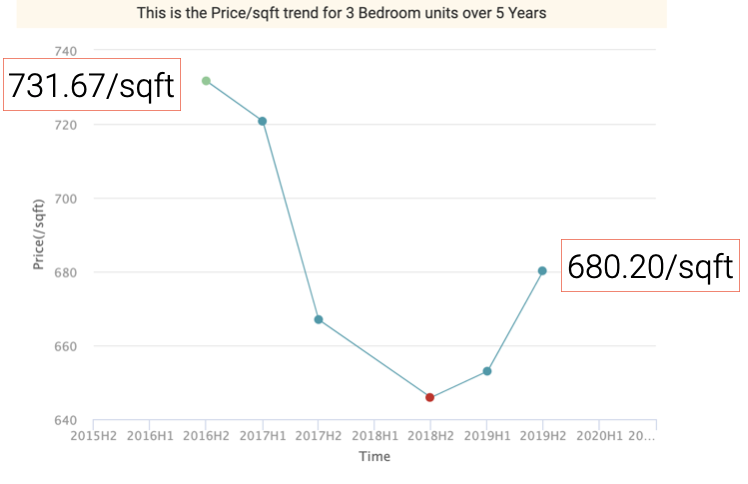

416A Clementi Avenue 1 was completed in 2012 which meant that it completed their minimum occupation period in 2017, although transactions already happened in 2016. If you look at the price trend, the price transactions in 2017H1 was SGD 720.75/ sqft and SGD 680.20/ sqft in 2019H2.

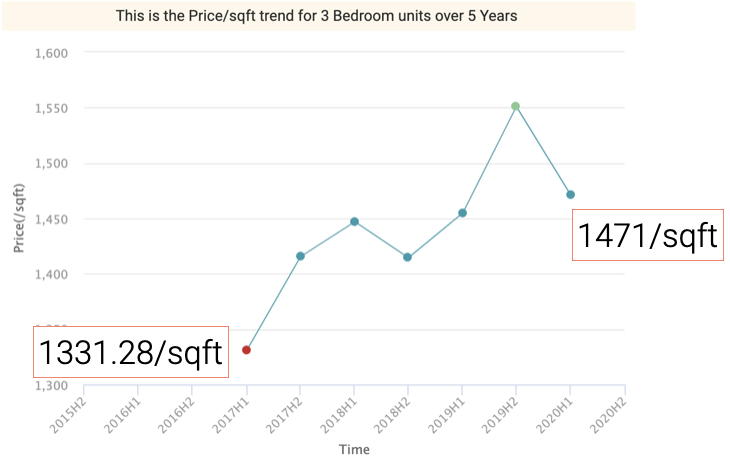

Clement Canopy is a joint venture 99-year leasehold development by UOL and Singland. Two 40-level buildings of 505 units. In 2017H1, the 3 bedroom units were transacted at SGD 1331.28/ sqft and SGD 1471/ sqft in 2019H2

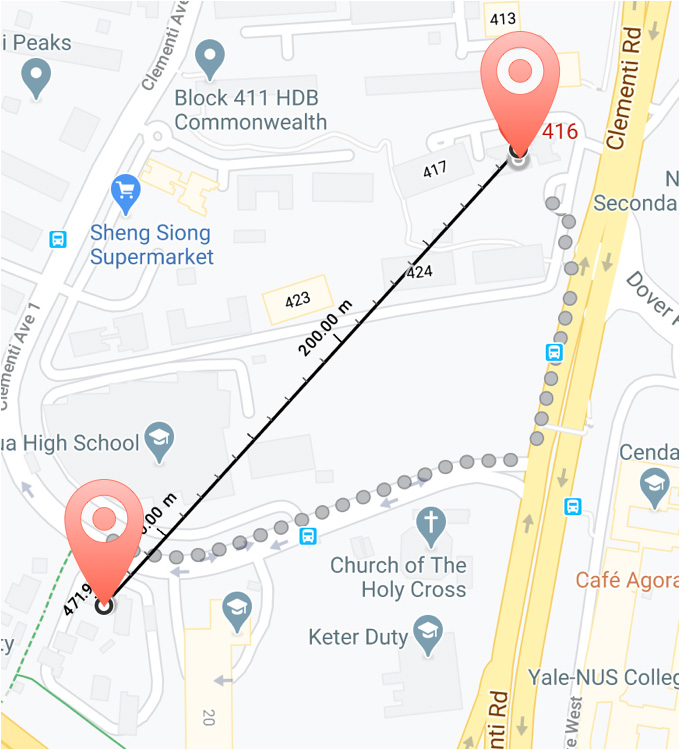

They are 200m apart. In real estate investing terms, these properties should perform similarly if they are both private properties. But as you can see below, they are not the same.

Calculations

Let’s compare Family A and Family B. Family A decides to upgrade immediately upon MOP to Clement Canopy. They chose an equivalent size 3-bedroom unit in Clement Canopy, while the other continues to stay at the current HDB flat.

Assumptions Taken

The following assumptions are taken.

- Timeline taken is from 2017H1 to 2019H2. H1 and H2 are identified as 1st Half and 2nd Half respectively. There are transactions recorded on both developments.

- Both families bought a midlevel 4-Bedroom 1000 sqft HDB flat at a median price of 500K

- Family A bought a 990 sq ft 3 room unit at Clement Canopy. For ease of calculation and due to the fact that the difference is only 10 sqft, we shall keep the 3 room unit at Clement Canopy size at 1000 sqft

- Bank Loan for Family A is based on 30-year tenure at 75% Loan to Value at a 2% interest rate.

- Profit from HDB calculated is simple for calculation’s sake. If you are curious how much you can get from HDB if you sell your MOP HDB, let me find them out for you in 5 minutes.

Timeline of Networth

Family A sold at 720,750K. With a profit of 220,750K. They then proceed to buy a 1000sqft unit for 1,279,000 on the 3rd floor (actual transaction).

The initial payment required from Cash and CPF = 355,510

Taking away the HDB sales profit of 220,750, the required CPF/Cash would be 134,760.

Family B remains with the flat that MOPed, assume all others equal

| Family A | Family B | |

| 2017H1 | 1,279,000 | 720,750 |

| 2017H2 | 1,415,430 | 667,000 |

| 2018H1 | 1,446,940 | 645,890 |

| 2018H2 | 1,414,500 | 656,445 |

| 2019H1 | 1,551,000 | 653,000 |

| 2019H2 | 1,455,000 | 680,200 |

Comparison of Annual Growth and Market Value

Calculating the annual growth and the value appreciation/ depreciation between the HDB and Clement Canopy over the past 3 years. We arrive to the following table

| HDB | Clement Canopy | |

| Annual Growth Rate | -1.93% | 4.31% |

| Value (Appreciation / Depreciation) | -1126.38 / Month | +4,888 / Month |

Conclusion

As you can see, 3 years after the HDB MOPed, Family A and Family B networth differ by a total of SGD 774,800. Dividing it per month, Family A’s networth increases SGD 2,690.25 every month.

Having said that, please know that this doesn’t happen every single time or that it only happens in Clementi but it helps tremendously if you have the real estate investing formulas helping you to purchase your private property.

Also, do note the following points

- It’s absolutely okay to stick with your HDB. I’ve seen HDB continuing to increase in value after MOP (Minimum Occupation Period) and I’ve also seen new launch private properties decrease in value after TOP (Temporary Occupation Permit). All I’m saying is that I can’t seem to find an investing formula that works for HDBs.

- It’s always okay to move to a smaller private property if you find finances a stretch. In fact, it’s always my opinion for those who are thinking between a larger size HDB or a smaller private property to start small. And make use of your private property to upgrade to a larger property in the future if you want. Make use of the intrinsic value of buying a piece of real estate that appreciates. If you are always looking for passive income, nothing can beat a real estate increasing in value the longer you hold it. A carefully selected unit bought at or below market value will help you achieve that goal.

- Owning a condo IS a possibility. Especially when you have money saved from your past 5 years while you wait for your 5 years minimum occupational period to end. A 3 room condo outside of the core region might cost you on average 1,200,000. A breakdown for such a unit is as follows

- A combined income of at least SGD 7,000

- A combined Cash/ CPF reserves of SGD 332,600

- Your monthly commitment is SGD 3,326 (combined) for a young couple. And if you are buying a new launch, you are only paying that amount in 2 – 3 years after your purchase, when the unit is already completed and ready to move in. Between the purchase and the completion, it is likely that your company’s CPF contribution will be able to cover the loan payment for at least the first year.

- Developers for new launches are flexible with the payment schedules. Unlike resale properties, if you need more time to save up the required amount, it’s always possible to discuss with the developers.

Hopefully, with this sample case, you might consider the advantages of upgrading to private property in the near future. The combined Cash/ CPF reserve might seem large but let’s not forget that the majority of this Cash/ CPF requirement can come from your sales proceeds for your existing HDB.

The remaining SGD 134,760 from this case can come from saving plans and CPF contribution from your company. This works out to be a combined monthly cash/CPF contribution of SGD 2,246 spread over a period of 5 years.

If you like this article and want to be kept updated on future articles like this, please like our Facebook Page and share to anyone who you think needs to read this post.

[efb_likebox fanpage_url=”https://www.facebook.com/datacrunchrealestate” locale=”en_US” responsive=”1″ show_faces=”1″ show_stream=”1″ hide_cover=”1″ small_header=”1″ hide_cta=”1″]

If you have a HDB that has MOPed or if you want to know more how it is possible for you to start your real estate investing journey, I’m here for you. Feel free to whatsapp me at the bottom right corner of this page or send me a message via the contact form below.

Looking forward to serve you soon!

Disclaimer

The information provided on this Datacrunch Real Estate website has been compiled for your convenience. All information (including but not limited to the property area, floor size, price, address and general property description) on the Datacrunch Real Estate website is provided as a convenience to you.

This disclaimer informs readers that the views, thoughts, and opinions expressed in the text belong solely to the author, and not necessarily to the author’s employer, organization, committee or other group or individual.

Datacrunch Real Estate does not accept liability for any investment decision made on the basis of this information. This website does not constitute financial advice and should not be taken as such.