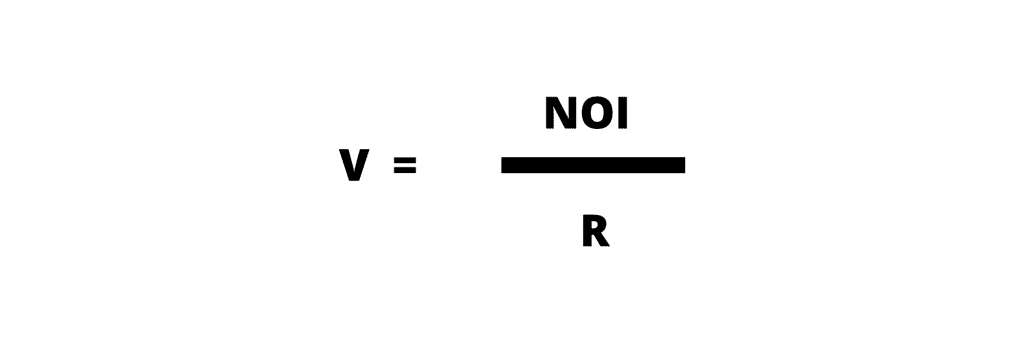

Formula

V = The Market Value of the property you are looking to buy

NOI = Net operating income of the property (Rent Income – Property Tax – Property Insurance – Maintenance Fees – expected Maintenance and Repair – Vacancies Loss )

R = Rate of Return on Capital

You need to estimate the rate of return of capital for the other properties by finding out the current market value and NOI of the nearby units and finding an acceptable rate of return of Capital for your selected unit.

Thus, with the estimated Income rent, you can multiply it with the rate of return of capital of the surrounding units to find out the estimated market value of the unit you are planning to buy

References

Millionacres Definition of Income Capitalisation Approach

Investopedia Definition of Income Capitalisation Approach

Corporate Finance Institute Definition of Income Capitalisation Approach